is cerb a revenue from work

TORONTO The Canada Emergency Response Benefit CERB has been an important backstop for employees laid off or unable to work during the pandemic lock down but it appears to be impeding small companies from staffing up as they reopen their businesses. Repay online using CRA My Account.

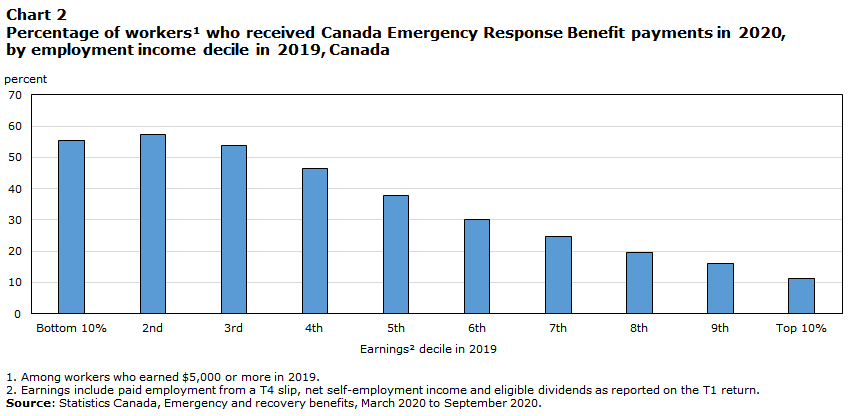

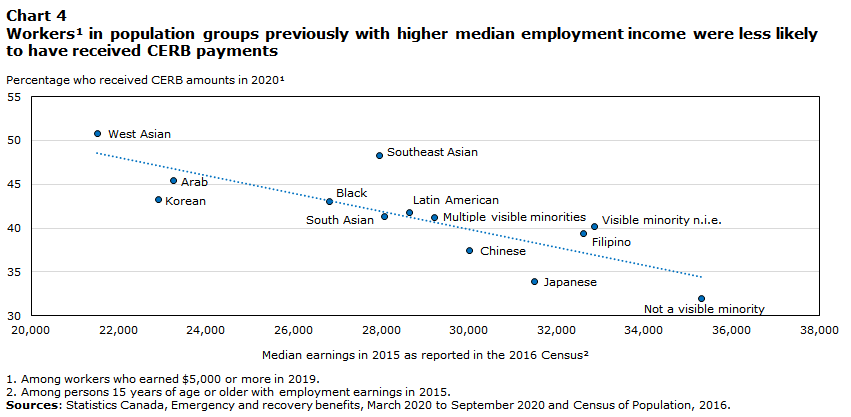

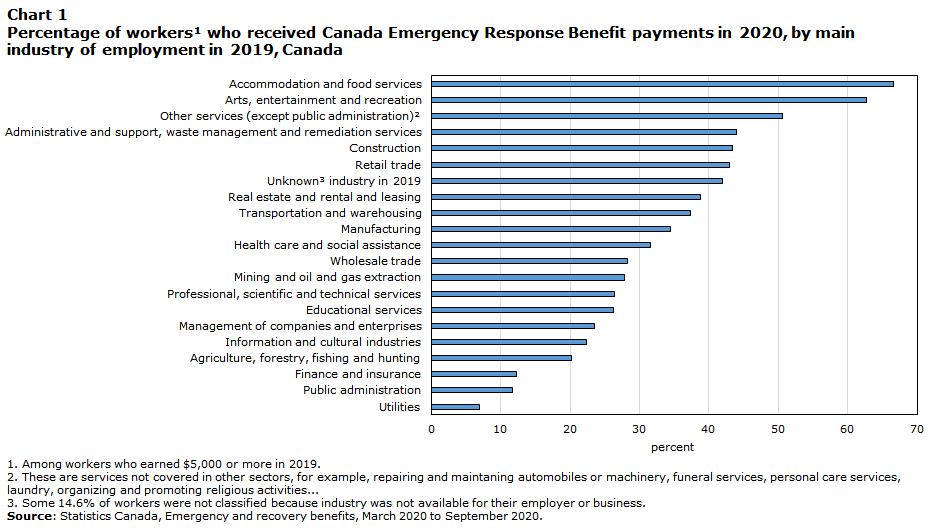

Workers Receiving Payments From The Canada Emergency Response Benefit Program In 2020

The CERB payments provide individuals with 500 per week.

. If they cannot verify your income you will receive a letter that states. It would help if you totaled your employment income income earned from other work your side hustle income from other sources AND the CERB payments. Support remains available for Canadians and businesses facing financial hardship due to Covid19 including extended and targeted benefits and programs that will help create jobs.

To be eligible for the 2000 CERB payment you must have met the following conditions during the period you were applying for. Transition to new COVID-19 benefits. For the CRB and other benefits a 10 per cent tax was withheld.

The 1000 before taxes includes royalties earned for work you did during those weeks you were applying for the CERB but not for work you did in other weeks. Canadian abroad You must have met all eligibility criteria to be eligible. You can continue to earn an income while collecting CERB but the limit is only up to 1000 per month.

The CRA is also warning that some recipients may potentially need to repay the agency. If you have a balance owing for 2020 your payment will be due on or before April 30 2021. If you are still unsure and concerned you might need to repay please contact the CRA at 1-800-959-8281 opens up phone application 1-800-959-8281.

Falconer said he always wondered whether hed have to. 11182021 The Community Economic Revitalization Board CERB approved 843750 in low-interest loans and 2431250 in grants for economic development and public infrastructure development targeting business growth job creation and broadband development in four counties. To verify your income CRA will look at your 2019 tax return and any T4 or other income slips sent into the CRA.

Information we have on file shows you may have earned over 1000. The federal government is looking to collect money it distributed through Canada Emergency Response Benefit CERB benefits. When it comes to the CERB and CESB no taxes were withheld by the government.

The Canada Revenue Agency CRA is sending out letters to COVID-19 aid recipients to verify that they were indeed eligible to receive payments throughout the pandemic. The Canada Revenue Agency CRA has sent thousands of letters to those that it believes may not have qualified for the benefit. Benefits like the CERB CESB and CRB are taxable income meaning they will show up on your taxes.

Over all the Ottawa paid out 816-billion in CERB and employment insurance to 89 million recipients between March 15 and Oct. The bottom line for landlords is that the CERB program offers a lifeline to tenants who cannot meet their rental obligations. The CERB and Returning to Work The CERB period has been extended to last until October 3 2020 entitling eligible individuals to a 500 a week benefit for up to 24 weeks.

The Canadian Federation of Independent Business CFIB reports a survey of small business. But among those contacted by CRA are CERB recipients who applied for federal aid based on having at least 5000 in gross income from self-employment in 2019 or in the 12 months prior to applying. This marks the second time the CRA is mailing Canada Emergency Response Benefit CERB recipients to.

The Canada Revenue Agency is sending out a new round of letters to pandemic aid recipients to verify they were eligible for the help and warning of. The Canada Emergency Response Benefit CERB provided financial support to employed and self-employed Canadians who were directly affected by COVID-19. For Canadians who are out of work due to the COVID-19 pandemic the governments introduced the Canada Emergency Response Benefit CERB.

Applicants for the CERB also need to be living in Canada and at least 15 years of age or. The Canada Revenue Agency reported the issues hours after applications for the benefits meant for those who have missed work due to the COVID-19 pandemic opened. You did not quit your job voluntarily.

The CERB is causing some confusion as employers re-call employees to work and some employees happily receiving the CERB are simply declining. You did not apply for nor receive CERB or EI benefits from Service Canada for the same eligibility period. The CERB received by a self-employed person will be treated in the same way as their total self-employment income that entitled them to the CERB.

If you earn enough to qualify for CERB but less than the necessary personal amount currently 12069 but may increase to 13229 then no income tax will be deducted from their CERB benefits. Applicants received 2000 for a 4-week period the same as 500 a week between March 15 and September 26 2020. To get support out to Canadians as quickly as possible people who applied for the CERB at the beginning of the pandemic received an advance payment says Carla Qualtrough minister of employment workforce development and.

You reside in Canada and are at least 15 years old. It also offers relief for landlords from the loss of rental revenue needed to operate their buildings in very difficult and demanding circumstances. You will need to report any taxable CERB payments you receive on your 2020 income tax return.

The Government of Canada says theyre going to work with Canadians who need to make a CERB repayment helping to create flexible payment schedules. Based on your response you need to repay the full 2000 to the CRA for each period that you were not eligible. To be eligible for CERB you must have earned employment or self-employment income of at least 5000 in 2019 or in the 12 months before applying.

Self Employed Canadians Who Got Cerb In Good Faith Shouldn T Be Punished Singh Says Ipolitics

Important Information About Seniors Benefits Reductions Related To Canada Emergency Response Benefits Cerb Core Alberta

Working From Home Or Collected Cerb Here S Everything You Need To Know About Filing Your 2020 Taxes Ctv News

Canadians Support Decision To End Cerb Innovative Research Group

Going Back To Work May Mean Paying Back Cerb Benefits For Some Employees 650 Ckom

How The Canada Emergency Response Benefit Is Failing Low Income Precarious Workers And How It Can Be Fixed The Law Of Work

Workers Receiving Payments From The Canada Emergency Response Benefit Program In 2020

Cra To Send Out New Round Of Letters Checking Eligibility From Cerb Recipients Citynews Vancouver

Workers Receiving Payments From The Canada Emergency Response Benefit Program In 2020

Canada Revenue Agency You Can Apply For Cerb Using 1 800 959 2019 Or 1 800 959 2041 Both Are Bilingual Automated Toll Free Lines With No Call Centre Agent Assistance Required Facebook

How To Apply For The Canada Emergency Response Benefit Cerb

Apply For Canada Emergency Response Benefit Cerb With Cra Todayville Calgary

Cra Sends Out Notices Asking Some Who Received Cerb To Verify Their Eligibility Citynews Toronto

Cerb Scammers Could Face Massive Fines Nicomen Indian Band

How To Apply For The Canada Emergency Response Benefit Cerb